*Oliver Wendell Holmes Jr.

Historically the American worker is the most generous in the world both in terms of numbers of givers AND amount given. The American worker gives like no other and when asked, gives even more.

Recently I have been hearing people say “I like to pay my taxes” as if it is a donation; as if they have a choice. It really doesn’t matter if you like paying them, or if you don’t MIND paying them, or if you hate paying them because the truth is, the government is going to take from you whatever they feel you owe however you may feel about it.

Taxes are NOT charity. The two should never be conflated. It’s obvious that the most important difference is that charity is voluntary while taxes are compulsory. What’s less obvious is that the choice you exercise when donating to a charity and the absence of choice when choosing how/when to pay your federal taxes directly impacts the efficiency with which each of those dollars are used.

With charity, you get to decide what cause or causes are worthy of your hard earned money and which are not, while with federal tax dollars, you have virtually no say what your money is used for. Like the slush fund kept by congressmen to shut down accusations of sexual harassment. Or the lifetime pension for anyone serving in Congress for just a single term. Or like the special health insurance just for our congressmen and women, which is light years better than ACA or Medicare.

Keep in mind that there is a threshold above which taxation must reduce charitable giving.

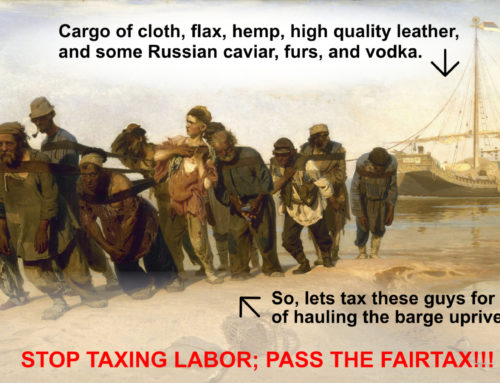

Income tax by its very nature is the MOST regressive tax. How can anyone think it’s right to single out a segment of our population, workers, for a special tax? Working men and women are already providing all of society’s goods and services. Why do we punish them with an income tax and a payroll tax?

And if you still like paying your federal taxes, how can you sit by silently while so many others game the system…LEGALLY??? It’s not being a cheapskate to insist everyone have some skin in the game.

While it IS patriotic to pay your taxes, it is a dereliction to pay excessive tax and Pollyanna-ish to happily pay taxes that are not applied equally.

Ultimately the question everyone should be asking is: “Under the FAIRTax will I be working more hours to pay my federal taxes?”

You can easily answer the question for yourself this way;

- The FAIRTax raises the same amount of money to fund the government as it is now raising.

- Entire swaths of the population who have not been paying taxes will begin paying tax.

-

Therefore the people who have been paying tax all along will pay about the same: some a little more, some a little less, but always driven by their spending choices.

Leave A Comment